The Indian government is reportedly working on a major revamp of the Goods and Services Tax (GST) structure for FY 2025-26. Currently, GST has four major slabs — 5%, 12%, 18%, and 28% (plus cess on luxury/sin goods).

To simplify the tax system, policymakers are considering reducing it to just two slabs — 5% and 18%.

This move aims to bring transparency, reduce litigation, and streamline tax compliance. But the big question remains: How will this affect prices of goods and services?

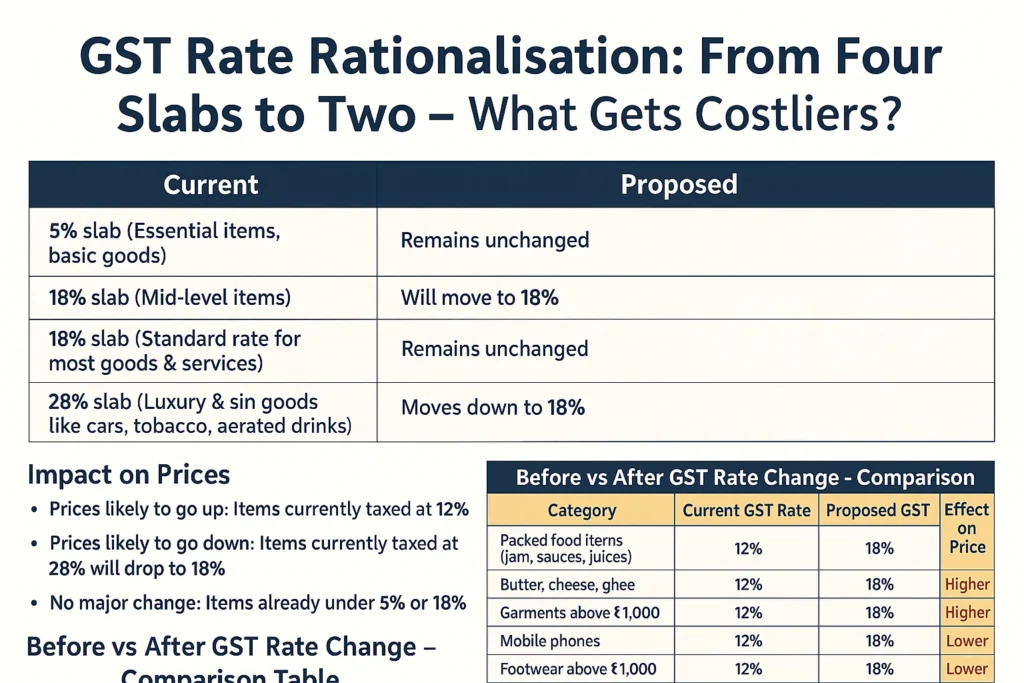

Current GST Slabs vs Proposed Slabs

- 5% slab (Essential items, basic goods) → Remains unchanged.

- 12% slab (Mid-level items) → Will move to 18%.

- 18% slab (Standard rate for most goods & services) → Remains unchanged.

- 28% slab (Luxury & sin goods like cars, tobacco, aerated drinks) → Will move down to 18%.

Impact on Prices

- Prices likely to go up: Items currently taxed at 12% will move to 18%.

- Prices likely to go down: Items currently taxed at 28% will drop to 18%.

- No major change: Items already under 5% or 18%.

Categories Affected

Items Likely to Become Costlier (12% → 18%)

- Processed food items (jam, sauces, packaged juice)

- Butter, cheese, ghee

- Mobile phones & accessories

- Paints and varnishes

- Ready-made garments above ₹1,000

- Refrigerators, washing machines

- Footwear above ₹1,000

Items Likely to Become Cheaper (28% → 18%)

- Automobiles (cars, two-wheelers – excluding cess)

- Air-conditioners

- Dishwashers

- Cement

- Luxury items (some cosmetics, perfumes)

- Aerated drinks (without cess)

Items with No Change (Remain 5% or 18%)

- Essential food items like rice, wheat, flour (mostly exempt or 5%)

- Medicines (5% and 12%, but some may move to 18%)

- Most services (18%)

- Electronics like laptops, TVs (already 18%)

Before vs After GST Rate Change – Comparison Table

| Category | Current GST Rate | Proposed GST Rate | Effect on Price |

|---|---|---|---|

| Packed food items (jam, sauces, juices) | 12% | 18% | Higher |

| Butter, cheese, ghee | 12% | 18% | Higher |

| Garments above ₹1,000 | 12% | 18% | Higher |

| Mobile phones | 12% | 18% | Higher |

| Footwear above ₹1,000 | 12% | 18% | Higher |

| Cement | 28% | 18% | Lower |

| Automobiles (without cess) | 28% | 18% | Lower |

| Air-conditioners, refrigerators | 28% | 18% | Lower |

| Aerated drinks (excluding cess) | 28% | 18% | Lower |

| Basic food items (rice, wheat, flour) | 5% | 5% | No Change |

| Medicines (5%/12%) | 5% / 18% | 5% / 18% | Mixed |

| Services (telecom, banking, IT, restaurants) | 18% | 18% | No Change |

Economic Impact

- Positive: Simplification of tax system, reduced classification disputes, better compliance.

- Negative: Middle-class consumers may face higher prices for daily-use items in the 12% slab.

- Industry gainers: Auto, real estate, FMCG (luxury segment).

- Industry losers: Food processing, textiles, footwear, mobile phones.

Also Read

Conclusion

Moving to a two-slab GST system (5% & 18%) will make India’s tax regime simpler and more business-friendly. However, the shift will have mixed impacts on consumers — some will enjoy lower prices (luxury & big-ticket goods), while others will pay more for everyday essentials like packaged food, garments, and mobile phones.